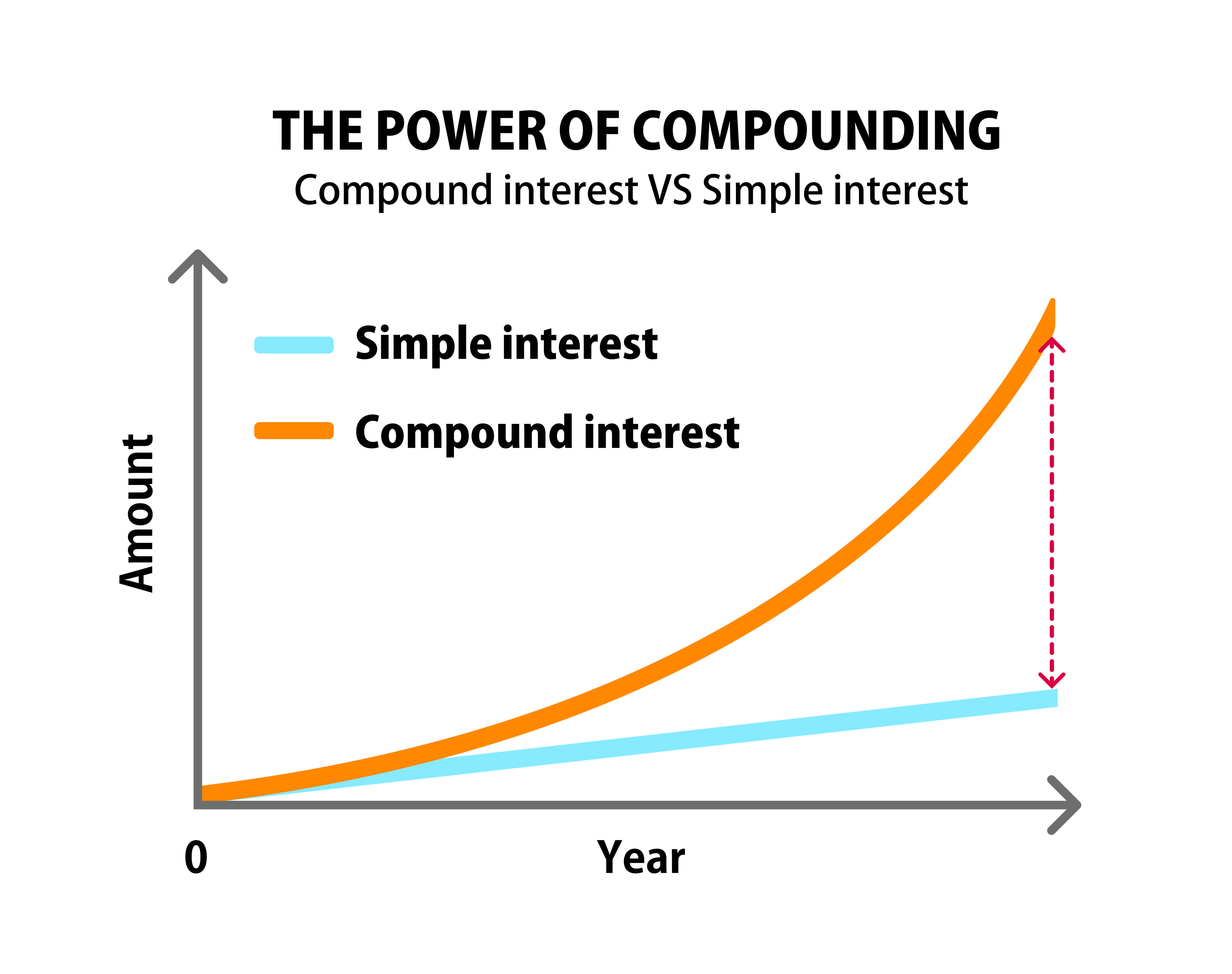

The longer you leave your money invested, the more it benefits from compounding. Time allows your investments to grow exponentially.

- Start Early: The earlier you begin, the more time your money has to compound. Even small contributions can grow significantly over time.

Regular contributions or investments, even if they are relatively small, can have a significant impact on your wealth when compounded over time.

- Consistent Saving/Investing: Make it a habit to save or invest regularly. Consistency is key to reaping the benefits of compound interest.

The frequency at which interest is compounded affects the overall growth. The more frequent the compounding, the faster your money grows.

- Avoid High-Interest Debt: Prioritize paying off high-interest debts like credit card balances, as they can erode your wealth faster than compound interest can build it.

A higher interest rate or rate of return on your investments leads to more substantial compounding growth.

- Seek Professional Advice: Consult a financial advisor to develop a personalized plan that aligns with your financial goals and risk tolerance.

Reinvesting dividends, interest, or capital gains back into the investment accelerates compound growth.

Risk is an inherent part of investing, and understanding and managing it is crucial for making informed financial decisions.

Risk-Return Tradeoff

Generally, investments with the potential for higher returns tend to come with higher levels of risk. Lower-risk investments often provide more stable but lower returns. The risk-return tradeoff is like a balancing act in the world of investments. It means that when you’re deciding where to put your money, you have to choose between two important things: the potential to make more money (returns) and the possibility of losing some of your money (risk).

Government Bonds vs. Cryptocurrency

Government bonds are generally considered low-risk investments because they are backed by a government. They offer more stability but typically have lower returns. Cryptocurrency, like Bitcoin, has the potential for significant returns, but it’s highly volatile and comes with a higher risk of losing money.

Stocks vs. Savings Account

Judy learns that stocks can have the potential for high returns, but they can also be quite risky because their value can go up and down a lot. On the other hand, a savings account is low risk because your money is usually insured and doesn’t change in value much, but the return (interest) is relatively low.

Investing in the Stock Market

Judy invests $5,000 in a diversified portfolio of stocks. On average, the stock market historically generates a 7% annual return, accounting for inflation and market fluctuations. In the first year, her investment grows to $5,350, earning $350. In the second year, the 7% return is calculated on the new total ($5,350), resulting in an increase of $374.50. Over decades, this compounding effect can lead to substantial wealth accumulation.

Diversification

Diversification can reduce the impact of poor performance in one investment on your overall portfolio. Diversification is like not putting all your eggs in one basket when you’re investing. It means spreading your money across different types of investments, like stocks, bonds, or real estate, instead of putting it all into just one thing. This can help make your investments safer.

Mitigate Risk: This means reducing the chance that you could lose a lot of money. Diversifying can make your overall investment less risky because even if one part of your portfolio goes down in value, the others may not, or they might go up.

Stock Diversification

Imagine you have $10,000 to invest, and you decide to buy shares in five different companies from various industries—technology, healthcare, finance, retail, and energy. If one company’s stock price drops significantly, the others may still perform well. So, your overall investment isn’t as affected by the poor performance of a single stock.

Individual Stocks: Invest in individual companies’ stocks and benefit from potential capital appreciation and dividends.

Asset Class Diversification

Instead of only investing in stocks, you also put some of your money into bonds and real estate. If the stock market takes a hit, the bonds and real estate might remain stable or even go up in value. This diversification across different asset classes can help protect your overall investment portfolio.

Real Estate

Rental Properties: Owning rental properties can generate rental income and property value appreciation over time.

Real Estate Investment Trusts (REITs): Invest in publicly traded REITs, which own and manage income-producing real estate assets. They often provide dividends.

Bonds and Fixed-Income Investments

Corporate Bonds: Purchase bonds issued by corporations, which pay periodic interest and return the principal at maturity.

Government Bonds: Invest in government-issued bonds like U.S. Treasury bonds, which are considered low-risk.

Mutual Funds or Exchange-Traded Funds (ETFs)

These are investment options that automatically diversify your money across a wide range of stocks or bonds. For example, you can invest in an S&P 500 index fund, which spreads your money across 500 of the largest U.S. companies. This way, you don’t have to pick individual stocks, and your risk is spread out.

Exchange-Traded Funds (ETFs): ETFs are investment funds that hold a diversified portfolio of assets, providing exposure to a broad market or specific sectors.

These funds pool money from multiple investors to invest in various securities, offering diversification.

So, diversification is a smart way to make your investments safer. It’s like having a safety net because if one part of your investments doesn’t do well, the other parts can help balance things out and reduce the overall risk in your portfolio.

Remember that all investments come with risks, and it’s crucial to conduct thorough research or seek advice from financial professionals to tailor your investment strategy to your goals, risk tolerance, and time horizon. Diversifying your investments across multiple asset classes can help spread risk and potentially enhance your ability to leverage compound interest effectively.

Risk Tolerance

Risk tolerance refers to both your ability and willingness to handle the ups and downs in the value of your investments. Understanding your risk tolerance is crucial because it helps you choose investments that align with your financial situation and emotional comfort. It ensures that your investment choices are in harmony with your overall financial goals and the level of risk you can realistically manage. It’s essential to align your investments with your risk tolerance to avoid making impulsive decisions during market volatility. Let’s break down this concept in simple terms:

This part of risk tolerance is about your financial capacity to handle potential losses. It depends on factors like your income, savings, and financial stability. If you have a higher ability to tolerate risk, it means you can afford to take chances with your investments without jeopardizing your basic needs and financial security.

This aspect of risk tolerance is more about your comfort level and emotional readiness to see your investments fluctuate in value. If you have a higher willingness to tolerate risk, you’re okay with the idea that your investments might go up and down, and you won’t get too anxious or make impulsive decisions when they do.

Investment Horizon

An investment horizon is like a financial timeline that shows how long you plan to keep your money invested in something, like stocks or bonds. Your investment horizon (the length of time you plan to hold an investment) can influence your risk tolerance. Longer horizons may allow you to take on more risk because you have more time to recover from potential losses. It’s an important concept because it can affect how much risk you can comfortably take with your investments. Here’s a simple breakdown:

The longer you plan to keep your money invested, the more you can typically handle some ups and downs in the value of your investments. This means you might be more willing to take on risk because you have more time to recover from any losses.

Short Investment Horizon (e.g., 1-3 years)

Suppose you plan to buy a car in two years. Your investment horizon for the money you’re saving for the car is short. In this case, you’d likely want to avoid high-risk investments because you won’t have much time to recover if your investments lose value before you need the money.

Intermediate Investment Horizon (e.g., 5-10 years)

Imagine you’re saving for a down payment on a house you plan to buy in seven years. Your investment horizon is intermediate. While you still want to be somewhat cautious, you might be more willing to invest in a mix of assets, including stocks, which can have higher potential returns, because you have time to ride out market fluctuations.

Homeownership: One of Judy’s goals is to become a homeowner within 10 years. Owning a home can be a valuable asset for generational wealth. But first she has to;

Improve Your Credit Score: Judy plans to save for a down payment and improve her credit score over the next decade to be in a strong position to purchase property. Like many Americans, she fell into the credit card trap and her goal is to pay it off within five years. This reduces financial stress and frees up more money for investing.

Pay Off Credit Card DeBt

Judy has $10,000 in credit card debt with an 18% interest rate. Her goal is to pay it off completely in five years. To do this, Judy knows she needs to grow her business.

Diversify Revenue Streams

Judy can diversify her business by adding complementary products or services. Setting a five-year goal for diversification can increase profitability.

Judy has discovered her knack for website building and social media marketing for her own business and has decided to offer full photography packages that include these services.

In addition, Judy has decided to launch a nonprofit to teach photography workshops to disadvantaged groups. She is able to fund these services for people who could otherwise not afford them.

Judy saves for a down payment and improves her credit score over the next decade, with the goal of purchasing her first home in a neighborhood with the potential for property value appreciation.